TAX TREATMENT - EQUITY COMPENSATION (U.S.)

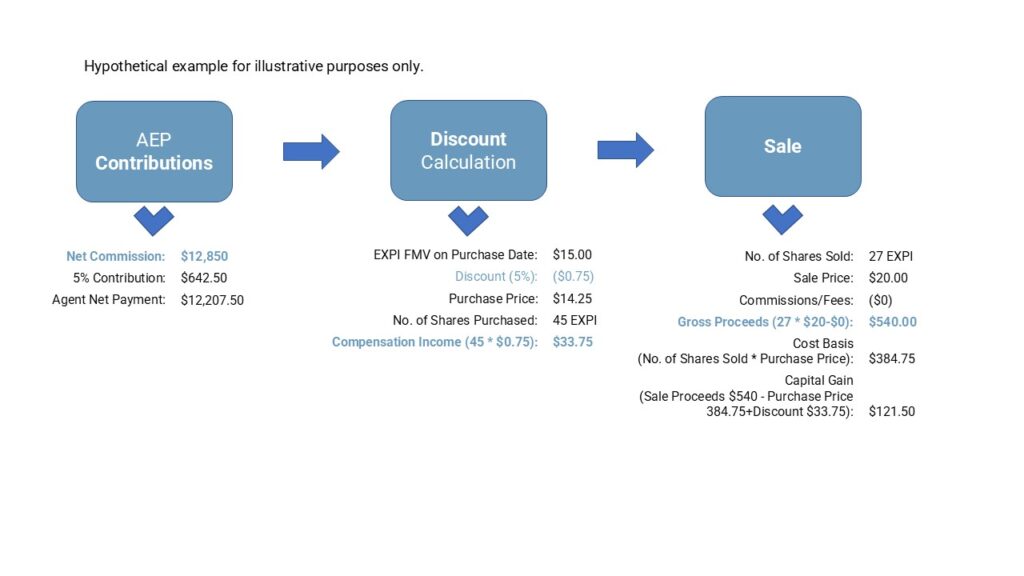

AGENT EQUITY PROGRAM (AEP)

AEP Events

“Stock Comp” Contributions

Purchase Discount

Sale

“Stock Comp” contributions from commissions (5%) for the purchase of stock is included on Form 1099-MISC from the eXp entity in which the agent has engaged services.

The discount upon purchase (5%) is considered compensation income and is reported on Form 1099‐NEC from eXp World Holdings, Inc.

Upon the sale of shares acquired through the AEP, the participant will recognize capital gain or loss* on the difference between the sale price and the tax basis (purchase price + discount amount).

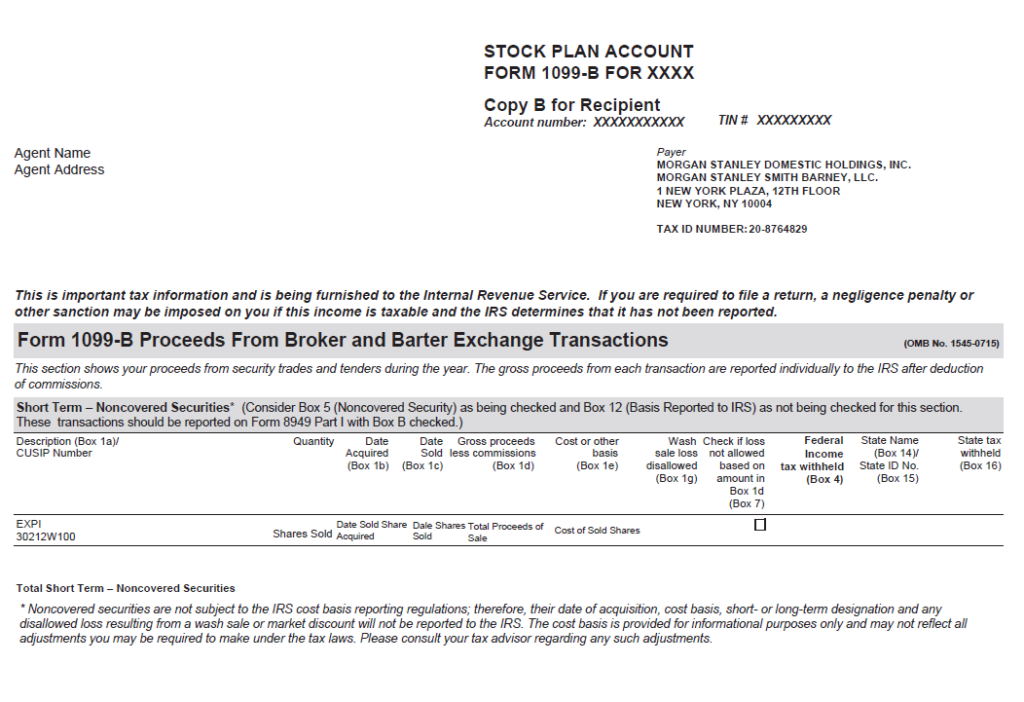

The institution that facilitates the sale will report the gross proceeds (minus fees and commissions, if any) on Form 1099-B.

*Whether such capital gain/loss would be a short‐ or long‐term gain depends on the length of time the shares are held before they are sold.

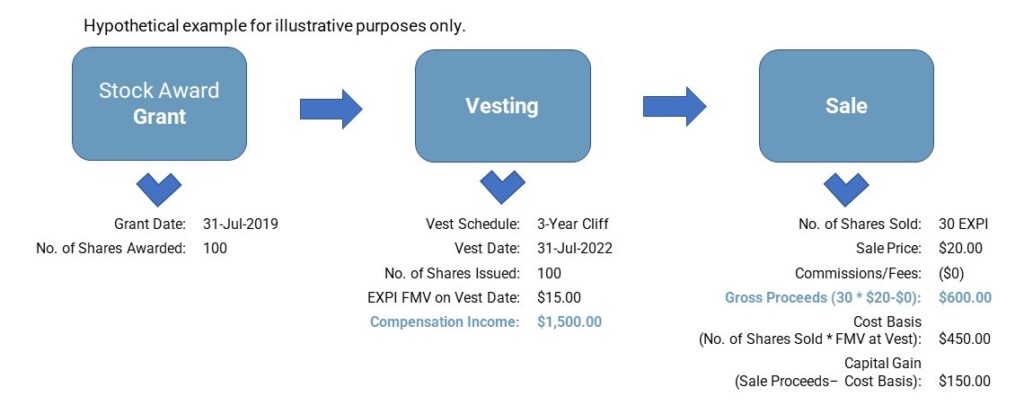

AGENT GROWTH INCENTIVE PROGRAM (STOCK AWARDS)

AGIP Events

Stock Award Grant

Vest Date

Sale

No compensation income is recognized upon receipt of a stock award.

Recipients will recognize compensation income at the time the stock award vests and the underlying shares are issued.

The income is equal to the fair market value (FMV) of EXPI stock on the vest date and is reported on Form 1099‐NEC from eXp World Holdings, Inc. eXp uses the closing price to calculate FMV.

Upon the sale of shares acquired through vested awards, recipients will recognize capital gain or loss* on the difference between the sale price and the tax basis (FMV on vest date).

The institution that facilitates the sale will report the gross proceeds (minus fees and commissions, if any) on Form 1099-B.

*Whether such capital gain/loss would be a short‐ or long‐term gain depends on the length of time the shares are held before they are sold.

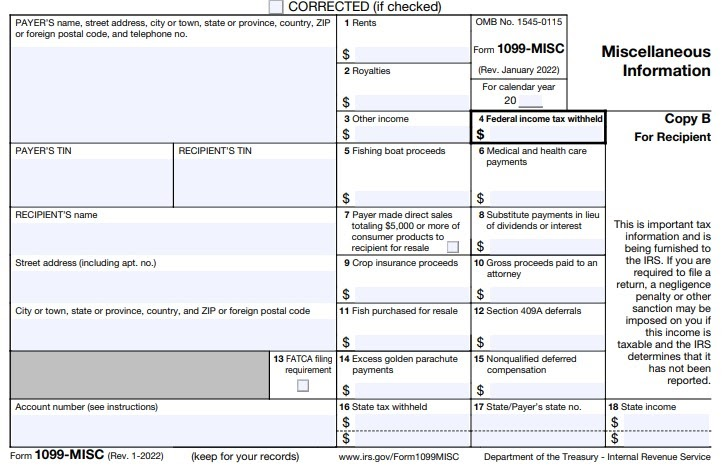

FORM 1099 EXAMPLES

1099-MISC (eXp Realty, Inc.)*

The amount reported in box 4 includes:

- Agent Net Commission Payments + AEP Stock Comp

- Revenue Share Payments

*eXp does not issue 1099s to corporations

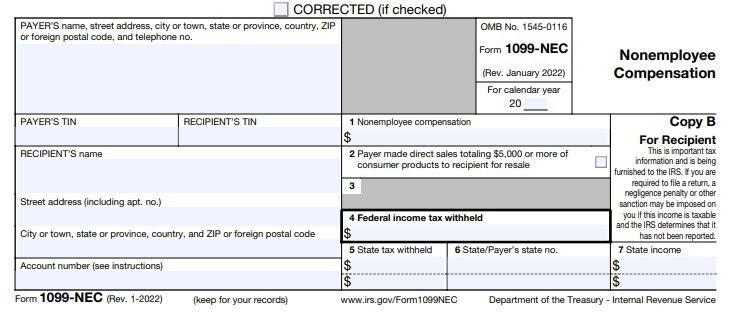

1099-NEC (eXp World Holdings, Inc.)

The amount reported in box 4 includes:

- Discount Amount for AEP Stock Purchase(s)

- Fair Market Value of Issued Shares from Vested Stock Awards

1099-B

A Form 1099-B will be issued by the institution where shares were held at the time of sale for any shares sold during the year.

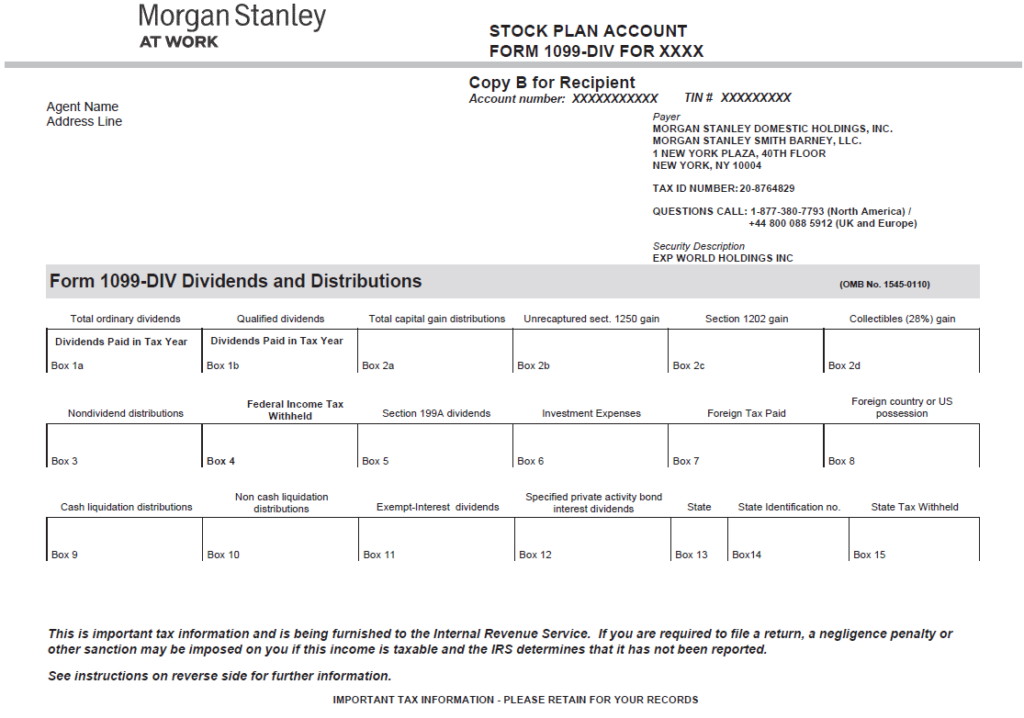

1099-DIV

- Boxes 1A and 1B will report the total dividends paid during the tax year across all events.

- This document will only post if you held qualified shares and received a dividend during the tax year.

FORM 1099 SUPPORT

eXp

For questions regarding tax documents received from eXp, visit Accounting Support in the World or email [email protected]. Be sure to include your eXp Enterprise Agent ID, name, and items in question within the body of the email.

If you need to update your legal name, tax ID or address with eXp, please fill out a W9 Update Form. Once filled out, please email [email protected] and notify Stock Plan Services to update Morgan Stanley at Work.

Morgan Stanley at Work

For questions regarding tax documents generated by Morgan Stanley, please call Morgan Stanley at Work at 1-877-380-7793 (8 a.m. – 8:00 p.m. ET) or visit https://support.solium.com/hc/en-us.

Broadridge

For questions regarding a Form 1099 received from Broadridge, please contact Broadridge Corporate Issuer Solutions at 1-800-586-1585 (M-F, 9 a.m. to 6 p.m. ET) or email [email protected].

All equity programs are governed by eXp World Holdings, Inc.’s (“EXPI”) 2015 Equity Incentive Plan as summarized in our 2015 EIP S-8 Prospectus, or the 2024 Equity Incentive Plan, as summarized in our 2024 EIP S-8 Prospectus (each of the 2015 Equity Incentive Plan and the 2024 Equity Incentive Plan, a “Plan” and together, the “Plans”).

In response to the EU Prospectus (“EU Prospectus”), EXPI provides Participants with additional information and guidance here: EU Prospectus. Any applicable translation of the EU Prospectus summary, that is published on the website of eXp World Holdings, Inc. can be found here: https://expworldholdings.com/financials/. Please read the EU Prospectus carefully before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the shares offered by EXPI under the Agent Equity Program. Your attention is called to the “Risk Factors” section of the EU Prospectus. Note that the approval of the Prospectus by the French Autorité des Marchés Financiers should not be understood as an endorsement of the securities offered under the EU Prospectus.

Pursuant to the Plans, the Agent Growth Incentive Program and Agent Equity Program are subject to modification or termination at the discretion of the Company’s Board of Directors.

If an agent has otherwise achieved one or more eligibility requirements to receive an award under the ICON Program, but the eligible agent, through no fault of his or her own or due to extreme or extenuating circumstances, should be unable to fulfill one or more remaining eligibility requirements, alternative eligibility requirements may be provided to such agent; such alternative eligibility requirements must be equal in effort to the requirement being substituted and otherwise compliant with the applicable Plan.

Ownership of shares issued under the equity programs may come with associated costs imposed by third parties, including but not limited to, fees that may be imposed by a stockbroker, financial services broker of agent’s choosing, or others.

EXPI has adopted an Insider Trading Policy that prohibits employees, directors, agents, and brokers from trading in EXPI stock based on material nonpublic information and from disclosing this information to others who may trade.

CURRENT ANNUAL REPORT:

For further assistance, visit the Agent Stock Programs home page for Agent Shareholder Support contact information.